Teledermatology Insurance Coverage: Essential Information for 2025

Learn about teledermatology insurance coverage in 2025, including what's covered, reimbursement, and the role of teledermatology apps like rash detectors.

Estimated reading time: 7 minutes

Key Takeaways

- Coverage varies by service type: Live video, store-and-forward, and hybrid teledermatology models each have distinct reimbursement rules.

- Standalone AI apps usually aren’t covered: Without a licensed provider’s sign-off, rash detector apps rarely qualify for insurance reimbursement.

- Integrated platforms offer promise: Partnering AI tools with telehealth providers can unlock billing codes and payer acceptance.

- Stay informed on policies: State licensure, CPT/HCPCS codes, Medicare flexibilities, and payer-specific rules evolve yearly.

- Documentation and billing codes matter: Proper coding, thorough visit notes, and well-captured images support successful claims.

Table of Contents

- Section 1: Understanding Teledermatology

- Section 2: Overview of Insurance Coverage in Telemedicine

- Section 3: Teledermatology Insurance Coverage Details

- Section 4: Does Insurance Cover Rash Detector App?

- Section 5: Healthcare Reimbursement for Teledermatology Apps

- Section 6: Steps to Ensure Coverage and Reimbursement

- Conclusion & Additional Resources

- FAQ

Section 1: Understanding Teledermatology

Teledermatology uses technology to let patients and dermatologists connect without an office visit. It can be:

- Live interactive (real-time video visits)

- Store-and-forward (asynchronous image and data exchange)

- Hybrid models (combining live and stored information)

Benefits of teledermatology:

- Expanded access for rural or underserved populations

- Faster triage and follow-up care

- Lower travel and time costs

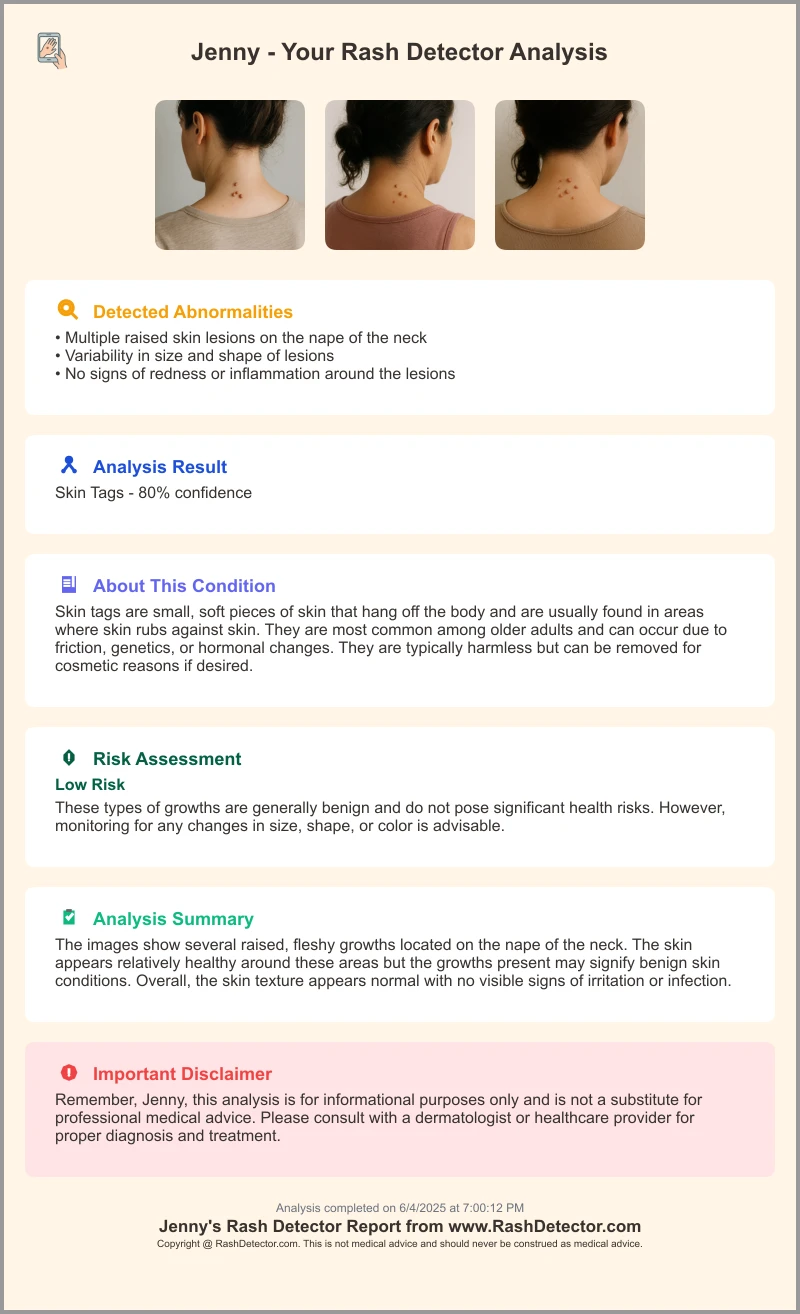

Rash detector apps are related tools that use image analysis to give a first look at skin spots or rashes. These apps can guide you before you see a professional—learn more in our AI Rash Detector App comparison.

Section 2: Overview of Insurance Coverage in Telemedicine

Insurance coverage means your plan pays all or part of the cost for services you use, under your policy’s rules. As telemedicine grew during COVID-19, many insurers updated policies to include digital health solutions. New rules and waivers helped cover video visits, phone consults, and remote monitoring. The focus here is teledermatology insurance coverage, a key slice of telehealth benefits. For tips on optimizing virtual evaluations, see our guide to Online Dermatologist Consultation.

- Digital health solutions now fall under many plans

- COVID-19 prompted temporary and permanent rule changes

- Teledermatology sits inside the broader telemedicine umbrella

Section 3: Teledermatology Insurance Coverage Details

Which teledermatology services get paid by insurers? Typical coverage includes:

- Initial consultations and diagnoses via live video or store-and-forward

- Follow-up visits for chronic skin conditions (e.g., psoriasis, eczema)

- Preventive skin checks by a licensed dermatologist

Coverage criteria and limits often depend on:

- State regulations and licensure requirements (provider must be licensed where patient lives)

- Provider accreditation (use of approved telehealth platforms)

- Service type (audio-only vs. video vs. asynchronous image review)

- Payer specifics (Medicare vs. private insurance)

Recent trends and stats:

- Continued payment parity in 2024; some flexibilities expire March 31, 2025

- Growth in covered store-and-forward codes

- More plans listing telehealth and teledermatology in benefit books

Section 4: Does Insurance Cover Rash Detector App?

Most insurers do not cover standalone automated rash detector apps without a provider involved. There are two main models:

- Standalone AI-based apps: Users upload photos, get an automated triage. Insurers usually don’t reimburse these because no licensed professional signs off.

- Integrated platforms: A licensed dermatologist reviews your images and issues a diagnosis or treatment plan. These services count as teledermatology and may be covered.

Challenges:

- No specific billing codes for pure AI tools

- Regulatory scrutiny on clinical validity of algorithms

Opportunities:

- Partnerships between app builders and telehealth providers

- Future billing codes for AI assistance in medical care

Section 5: Healthcare Reimbursement for Teledermatology Apps

Healthcare reimbursement is how providers get paid for the services they deliver, digitally or in person. For teledermatology, common models are:

- Using existing CPT/HCPCS telehealth and store-and-forward codes

- State parity laws that require equal pay for remote vs. face-to-face visits

- Medicare’s temporary telehealth flexibilities extended through September 2025

Future outlook:

- New billing codes for AI-driven diagnostics could emerge

- CMS rulemaking may add or remove flexibilities each year

- Payers will track cost-effectiveness and quality measures to decide ongoing coverage

Section 6: Steps to Ensure Coverage and Reimbursement

Use this checklist to boost your chances of getting teledermatology claims paid:

- Verify plan details: Log into your insurer’s member portal or call customer service to confirm teledermatology insurance coverage.

- Check provider credentials: Make sure your dermatologist is licensed in your state and uses an approved telehealth platform.

- Document consultations: Save visit notes, photos, and treatment plans to back up your claim—capture clear images following Best Practices for Mobile Rash Imaging.

- Use correct billing codes: Reference the latest CPT/HCPCS codes for telehealth and store-and-forward services.

- Appeal denials: If a claim is denied, review the insurer’s appeal process and submit paperwork showing medical necessity.

- Monitor policy updates: Subscribe to CMS newsletters and your state telehealth board announcements for changes.

Conclusion

Teledermatology expands access to skin care by removing geographic and time barriers. Coverage varies by plan, state, and type of service. Standalone rash detector apps generally lack direct insurance coverage unless a licensed provider is involved. Sustainable healthcare reimbursement for teledermatology relies on established telehealth billing codes and evolving policies. Understanding these rules helps patients get care they need and providers get paid fairly. Always confirm your plan’s terms and talk to your provider about coverage details.

Additional Resources

- CMS Telehealth FAQ 2025

- Good News: Telehealth Extended Through September 2025

- Teledermatology Billing in 2025

- What Is Teledermatology?

- Teledermatology Before, During, and After COVID-19

FAQ

- Does insurance cover teledermatology visits?

Most major insurers, including Medicare, cover live video and store-and-forward dermatology visits when provided by a licensed dermatologist and billed with the correct codes. - Can I get reimbursed for using a rash detector app?

Pure AI-only apps without clinician involvement aren’t typically covered. Reimbursement is possible when the app is part of an integrated telehealth platform reviewed by a provider. - What billing codes should I use?

Use CPT/HCPCS telehealth codes (e.g., 99421–99423) and store-and-forward codes (e.g., 96900 series) as appropriate, and verify payer-specific guidelines. - How do I appeal a denied telehealth claim?

Review your insurer’s appeal process, gather documentation of medical necessity and visit records, and submit a formal appeal with supporting notes and images. - Where can I find updates on telehealth policies?

Monitor CMS announcements, state telehealth board websites, and payer bulletins. Subscribing to relevant newsletters ensures you catch rule changes early.