Investment in Skin Tech Startups: AI Dermatology Trends and Market Growth

Explore the growth potential of investment in skin tech startups, focusing on AI dermatology trends and key market players shaping the industry's future.

Estimated reading time: 8 minutes

Key Takeaways

- AI Innovations: Emerging technologies enable real-time skin analysis and drug discovery.

- Market Growth: The AI skin tech market is projected to exceed $8 billion by 2035.

- Funding Landscape: Venture capital and corporate investors are actively supporting top startups.

- Success Stories: Companies like SkinVision and DermTech showcase strong clinical partnerships.

- Challenges & Opportunities: Regulatory pathways, data privacy and algorithmic bias must be navigated.

- Future Outlook: Personalized, integrated solutions and genomics convergence will drive the next wave.

Table of Contents

- Introduction

- Current Trends in AI Dermatology

- Market Growth Analysis

- Investment Landscape

- Key Startups and Success Stories

- Challenges and Opportunities

- Future Outlook

- Conclusion

- FAQ

Introduction

Investment in skin tech startups refers to the allocation of capital toward early‐stage companies using AI, machine learning, computer vision and related technologies to improve skin health, diagnostics and care. Investors today can back firms that harness artificial intelligence in dermatology to spot skin issues faster, recommend personalized treatments and deliver care via mobile and telemedicine platforms.

As AI adoption rises, these startups enable data‐driven diagnostics that outperform traditional exams, offer remote monitoring through smartphone apps and power new drug discovery for conditions such as psoriasis, acne and skin cancer. Future Market Insights and Precedence Research highlight rapid market expansion driven by innovation and consumer demand.

This blog provides an in‐depth analysis of current AI dermatology trends, market growth projections, the investment landscape, standout startup success stories, key challenges and the future outlook. By the end, investors will have clear insights to navigate this high‐potential space.

Current Trends in AI Dermatology

Real-Time Skin Analysis

- AI systems use image recognition to detect fine lines, sun damage and blemishes within seconds.

- Computer vision algorithms compare live skin scans against large databases, improving accuracy over time.

- Example: A teledermatology platform screens moles via smartphone photos, flagging suspicious lesions for follow-up.

AI in Drug Discovery

- AI models mine genomic and proteomic data to identify new targets for psoriasis, acne and melanoma treatments.

- Automated simulations cut drug candidate selection time from years to months.

- Startup spotlight: An AI‐based firm reported a 30% improvement in identifying novel anti‐psoriasis compounds.

Non-Invasive Diagnostic Tools

- Patch‐based sensors measure skin hydration and pH, feeding data to AI for health assessments.

- Photo-based diagnostic apps provide instant feedback on skin health, enabling preventive care.

- Clinical trial: An AI tool matched dermatologist accuracy in detecting eczema flares 92% of the time.

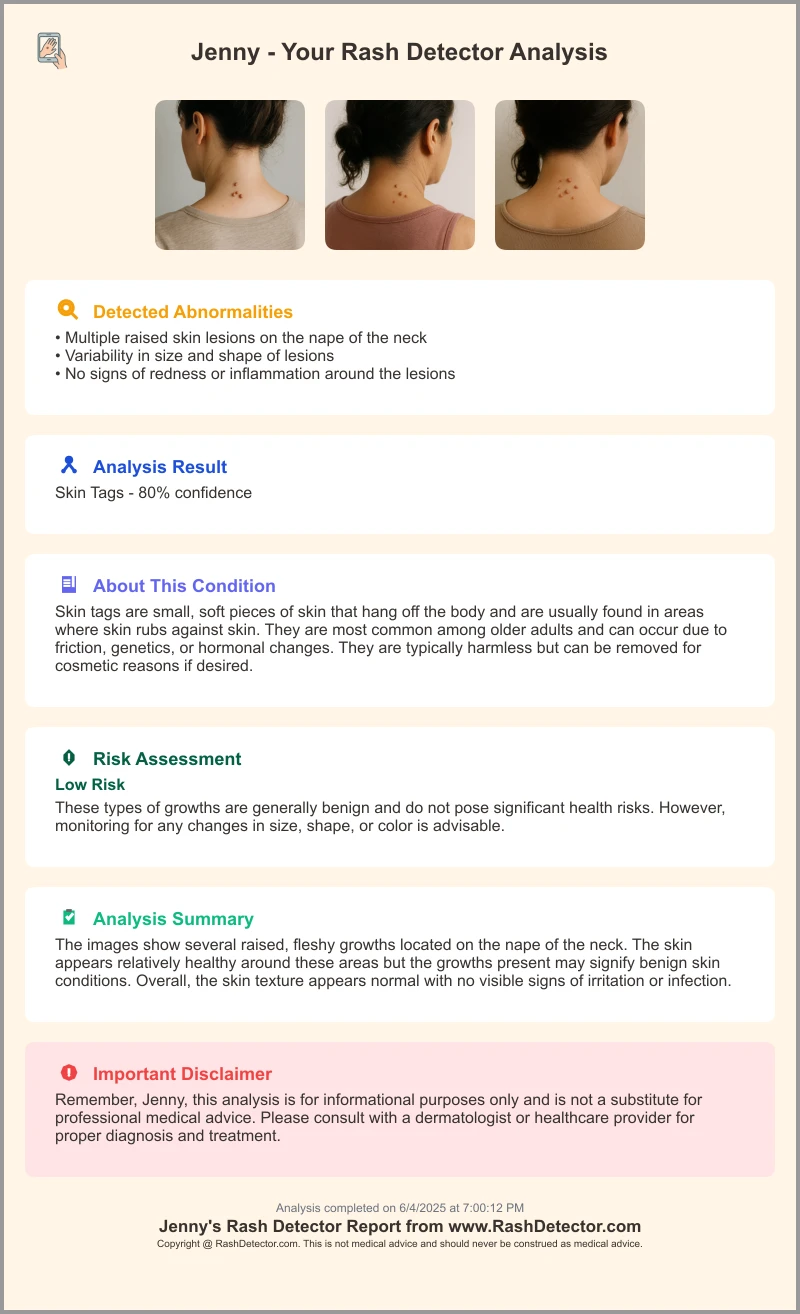

Consumer-facing apps also collect large datasets for continuous improvement. For example, users can upload images to Rash Detector to receive instant skin analysis reports.

Market Growth Analysis

The AI skin tech market is on a rapid growth trajectory, offering significant opportunities for venture capital and corporate investors.

Projected Market Size

- The global AI skin market is projected to grow from $1.79 billion in 2025 to $8.26 billion by 2035 at a CAGR of over 16%.

- AI‐powered drug discovery in dermatology may reach $1 924.6 billion by 2034, driven by bioinformatics advances and high‐throughput screening.

Key Growth Drivers

- Rising prevalence of skin disorders such as acne, eczema and skin cancer.

- Consumer demand for personalized and preventive skincare solutions.

- Technological innovation boosting diagnostic accuracy and remote care access.

- Expansion of teledermatology services fueled by smartphone penetration and telehealth adoption.

Regional Insights

- North America leads due to high R&D spending and advanced healthcare infrastructure.

- Europe follows, supported by strong telemedicine networks and active startup ecosystems.

- Asia-Pacific shows emerging potential as digital health initiatives expand in China and India.

Investment Landscape

Investors are pouring capital into AI dermatology startups, drawn by strong growth metrics and disruptive potential.

Regional VC Activity

- North America holds over 60% of global venture deals in skin tech.

- Europe has seen a 25% year-on-year increase in investments from biotech funds.

- Asia’s ecosystem is maturing with strategic investments from tech giants.

Key Investors and Partners

- L’Oréal Ventures invests in AI-driven skin analysis tools for consumer products.

- IBM Watson Health partners with startups to enhance AI diagnostics and decision support.

- Google Health funds teledermatology platforms to reach underserved regions.

Attractive Features

- High growth rates and large addressable markets across dermatology, cosmetics and wellness.

- Disruption potential in screening, monitoring and drug discovery workflows.

- Strong exit prospects via acquisitions by major healthcare and beauty corporations.

Key Startups and Success Stories

SkinVision

- AI-driven melanoma risk assessment via smartphone app.

- Over $17 million raised across Series A and B rounds.

- Partnerships with clinics in Europe and Australia for large-scale trials.

DermTech

- Non-invasive genomic testing patches to detect malignant skin cells.

- Used by over 200 dermatology clinics in the US.

- Alliances with pharma firms for biomarker research.

FotoFinder

- Advanced imaging devices with deep-learning lesion analysis.

- B2B sales of systems to practices plus subscriptions for AI updates.

- Acquired a teledermatology platform to expand digital services.

Challenges and Opportunities

Major Risks

- Regulatory hurdles: FDA and EMA approvals can be time-consuming and data-intensive.

- Data privacy and security: Ensuring HIPAA and GDPR compliance is essential.

- Algorithmic bias: Models must cover diverse skin types to avoid unequal outcomes.

- Competition: Large medtech and pharma players raise the bar for startups.

Emerging Opportunities

- Clinical partnerships with hospitals and telemedicine providers.

- Wearable integration: Skin sensors in smart patches for continuous monitoring.

- D2C teledermatology as smartphone use grows globally.

Balancing Risk and Return

- Evaluate clinical validation studies and regulatory strategies.

- Assess platform scalability across clinics or consumer apps.

- Monitor adoption metrics such as user retention and partnership growth.

Future Outlook

Next-Gen AI Models

- Real-time analytics on smartphones and IoT devices.

- Deep-learning frameworks that account for genetics, lifestyle and environment.

AI-Powered Drug Discovery Pipelines

- Targeted therapies for rare dermatologic conditions.

- Synthetic data and in-silico trials to fast-track approvals.

Convergence with Genomics and Precision Medicine

- Personalized routines based on genetics, microbiome and skin profiles.

- End-to-end chronic disease management via telemedicine platforms.

Investor Recommendations:

• Prioritize startups with strong clinical data and regulatory clarity.

• Seek teams with expertise in both AI and dermatology.

• Focus on scalable SaaS or device-as-a-service models.

• Stay updated on reimbursement policies and privacy regulations.

For further insights, see future AI dermatology care.

Conclusion

Investment in skin tech startups has emerged as a transformative, high-growth opportunity at the crossroads of healthcare, beauty and advanced technology. We explored AI dermatology trends, market projections, the investment landscape, leading startups, challenges and future directions.

For investors ready to capitalize, due diligence on clinical validation, regulatory readiness and partnership potential is key. With careful selection, investments in skin tech startups can yield significant returns while advancing skin health.

FAQ

- What defines a skin tech startup? Companies that leverage AI, machine learning or computer vision to improve skin health diagnostics, monitoring or treatment.

- How large is the AI dermatology market? It is expected to grow from $1.79 billion in 2025 to over $8 billion by 2035.

- Which investors are active in this sector? Leading backers include L’Oréal Ventures, IBM Watson Health and Google Health.

- What are the main risks? Key risks include regulatory approvals, data privacy, algorithmic bias and competition from established players.

- Which startups should I watch? SkinVision, DermTech and FotoFinder are notable for their innovation, partnerships and funding histories.